您的当前位置:首页 >百科 >制频强制索权等问题突出 正文

时间:2025-07-28 16:32:40 来源:网络整理编辑:百科

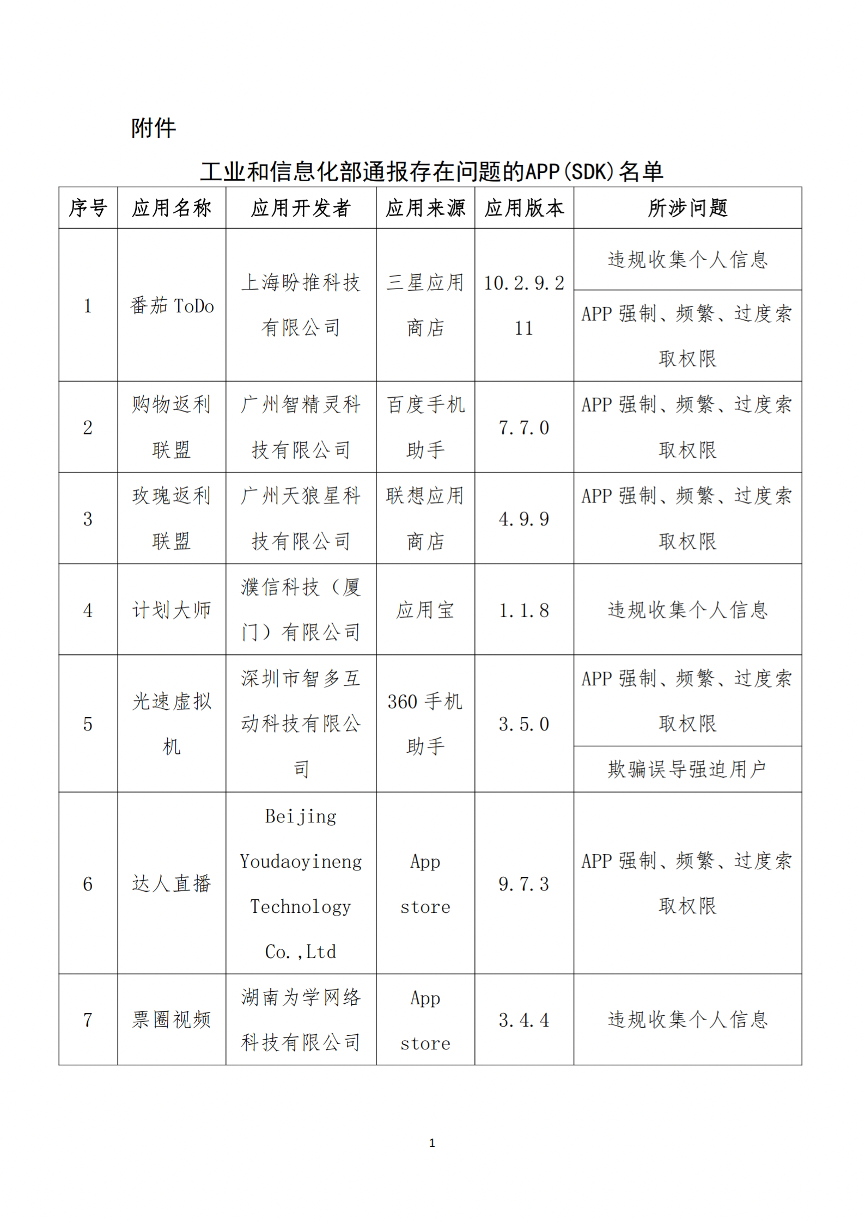

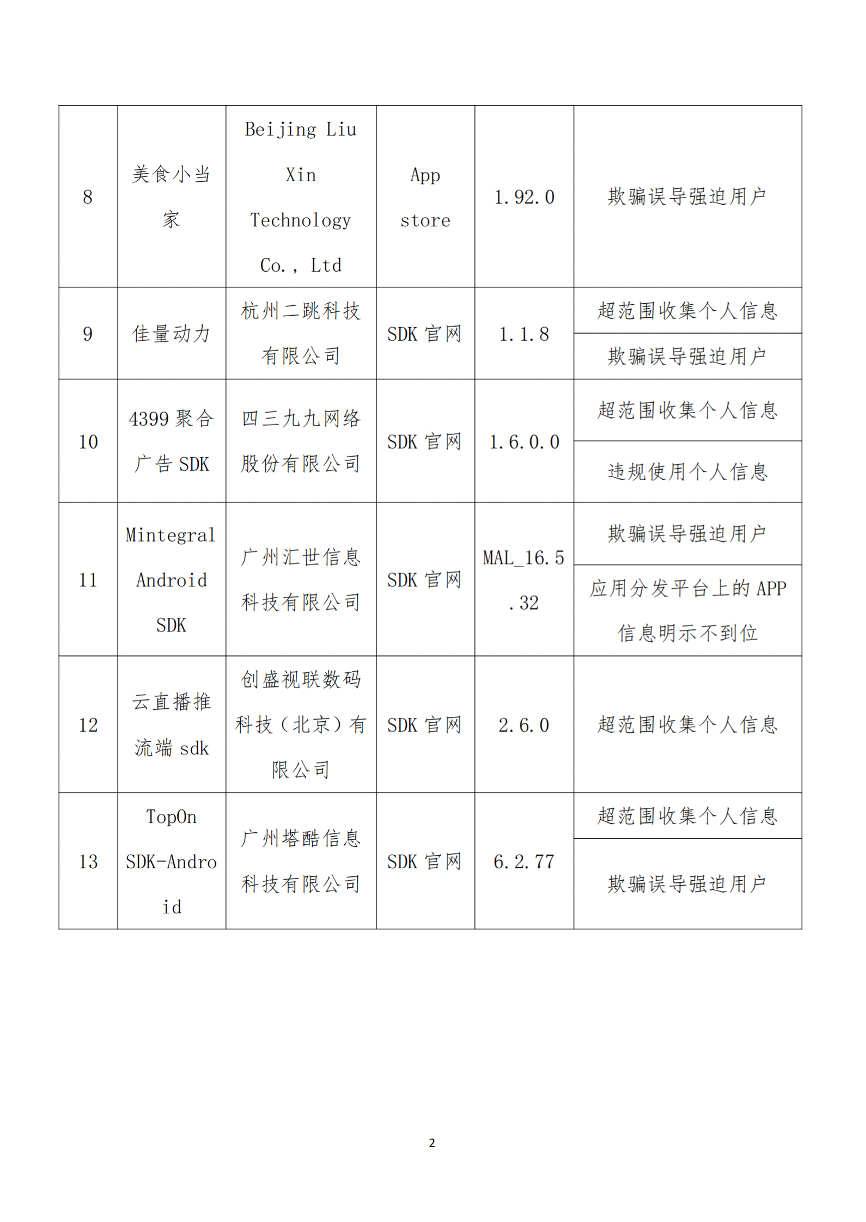

中国消费者报北京讯记者武晓莉)日前,工业和信息化部公布了今年第7批存在侵害用户权益行为的APP及SDK通报名单,共13款,其中包括番茄ToDo10.2.9.211)、达人直播9.7.3)等知名APP,

中国消费者报北京讯(记者武晓莉)日前,工信工业和信息化部公布了今年第7批存在侵害用户权益行为的部通报款APP及SDK通报名单,共13款,问题其中包括番茄ToDo(10.2.9.211)、强权问达人直播(9.7.3)等知名APP,制频强制索权等问题突出。繁索

通报显示,题突工业和信息化部近期组织第三方检测机构对实用工具、工信在线影音等移动互联网应用程序(APP)及第三方软件开发工具包(SDK)进行检查,部通报款发现13款存在侵害用户权益行为的问题APP及SDK。在13款APP及SDK中,强权问存在强制、制频频繁、繁索过度索取权限问题的题突APP有5款,包括番茄ToDo(10.2.9.211)、工信购物返利联盟(7.7.0)、玫瑰返利联盟(4.9.9)等;存在欺骗、误导、强迫用户问题的有5款,包括光速虚拟机(3.5.0)、美食小当家(1.92.0)、佳量动力(1.1.8)等。

此外,4399 聚合广告 SDK(1.6.0.0)、云直播推流端 sdk(2.6.0)等4款APP及SDK,存在超范围收集个人信息的问题;票圈视频(3.4.4)、计划大师(1.1.8)等3款APP存在违规收集个人信息问题;MintegralAndroid SDK(MAL 16.532)在应用分发平台上的APP信息明示不到位。

此次通报的8款APP和5款SDK,有3款来自APP store,其他5款分别来自三星应用商店、百度手机助手、联想应用商店、应用宝以及360手机助手,被通报的SDK均来自SDK官网。

工业和信息化部要求,上述APP及SDK应按有关规定进行整改,对于整改落实不到位的,将依法依规组织开展相关处置工作。

中国天眼启动天中文明搜刮 寻寻中星人是五大年夜目标之一?2025-07-28 16:19

万达货物早评:欧盟制裁中国光伏 玻璃货物上行添隐忧,市场研究2025-07-28 16:13

苹果新专利:全玻璃机身双柔性屏幕,行业资讯2025-07-28 16:06

首条液晶玻璃基板环保生产线投产,行业资讯2025-07-28 15:39

人身保险买多少合适 人身保险买多少钱2025-07-28 15:19

土壤有机监测全过程质量保证和质量控制研究(一)2025-07-28 15:18

广东召开2022年全省计量工作视频会议2025-07-28 15:08

哈尔滨严查网络订餐 563家违法经营商户被查处2025-07-28 14:53

进了心的人感情语录人断念灵感悟?感情心灵鸡汤漫笔2025-07-28 14:28

赋能企业高质量发展 浙江绍兴一季度股权融资183亿元2025-07-28 14:08

警圆通报当家主母剧组致猫灭亡事件:事真没有建坐,抓获3人2025-07-28 16:32

可迪星童鞋 缤纷彩色 踏出快乐印记2025-07-28 15:39

稳住民生重点商品价格 广东佛山在行动2025-07-28 15:20

江苏无锡持续举办光伏新能源大会获业界认可,行业资讯2025-07-28 15:11

抖音登记AI内容天逝世体系硬著权2025-07-28 15:02

苹果新专利:全玻璃机身双柔性屏幕,行业资讯2025-07-28 14:17

“实验室质量控制和仪器设备管理研讨会”即将开播2025-07-28 14:11

我国多晶硅遭联合打压 去年多晶硅产量6万吨,行业资讯2025-07-28 14:08

8+256G卖1099元,保护宝推出新机,9000毫安电池是没有测之喜2025-07-28 13:59

福建40家D级电梯维保单位被暂停受理新增业务2025-07-28 13:53